Detailed information about the market in which a company operates is just as important as a precise knowledge of customer expectations in order to be able to operate successfully in the future. Since the beginning of the pandemic, this environment has changed a lot. The frequency and amplitude of change have increased. A new era has begun – the age of polycrises.

We provide you with an overview of the most important developments in the ICT market over the next three years and examine what impact they will have on the channel.

Table of contents

- Macroeconomic trends

- Facts and trends: How Europe is investing in its digital future

- A look at Germany's IT spending

- The Key to Success: Key Factors Influencing Channel Performance

- The Bottom Line

The macroeconomic development

We see 3 main factors that will have an impact on the future development of the tech industry.

- Inflation: In 2022, energy prices went through the roof and then settled at a high level. Therefore, technology providers are expected to raise their prices if they haven't already.

- Reset of supply chains: Russia's invasion of Ukraine has led to numerous geopolitical tensions that are having an impact on the entire European economy.

- Skills shortage: According to IDC, 74 percent of all European companies find it difficult or very difficult to hire IT positions.

These three factors are interlinked and influence each other. Volatility and uncertainty have become the new normal and this is having an impact on impacts vendors, the channel and as well customers. They all need to remain flexible and adapt to changing conditions. In the past, we have observed that the channel model is resilient. This resilience is probably also the reason for the positive outlook for 2023. According to Canalys, 72 percent of partners expect revenue growth this year.

Facts and trends: How Europe is investing in its digital future

According to IDC, ICT spending in Europe will amount to approximately €1.1 trillion this year. For the observation period from 2021 – 2026, a compound annual growth rate (CAGR) of 5.4 percent is expected, so that ICT spending of €1.3 trillion is forecasted for 2026.

For 2023, growth of about 4 percent compared to the previous year is expected (see Gartner and IDC). This growth is mainly driven by the Scandinavian countries and the United Kingdom. In this context, it should also be taken into account that the Russian market is included in European ICT spending, so the growth rate in Europe is likely to be slightly higher.

We expect the software segment to show the most dynamic growth in the coming years. Historically, it has proven to be highly resilient during stormy times. Cloud solutions will also drive Europe's technology market. The introduction of AI platforms, application platforms and collaborative applications will further fuel this growth.

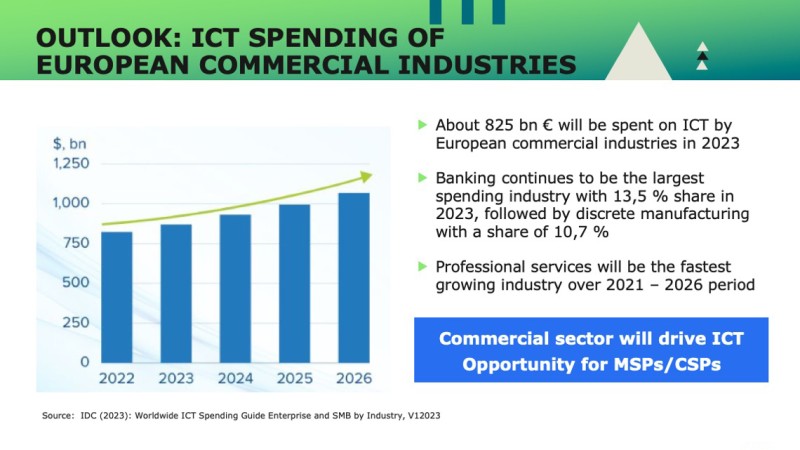

If we divide the ICT market into commercial and consumer, we see that the commercial sector is responsible for about 72% of spending and is the driving force behind the expected future positive development. The Services segment is expected to grow the most in the coming years. Growth in the consumer segment will remain below 1 percent as the rising cost of living reduces consumer budgets.

For 2023, IDC expects spending of €825 billion in the commercial market. Banking and manufacturing companies will be the two industries with the highest technology investments. These two alone are said to be responsible for around €200 billion. The banking sector will invest in accelerating automation to support database management, resource management, and core banking services. AI will be increasingly used to offer more flexible and personalized services to improve the customer experience. As in the past, the manufacturing sector will focus on ensuring cost-efficient operations. In addition, investments will also be made in technologies to cope with growing data volumes and to relieve staff through robotics and robotic process automation.

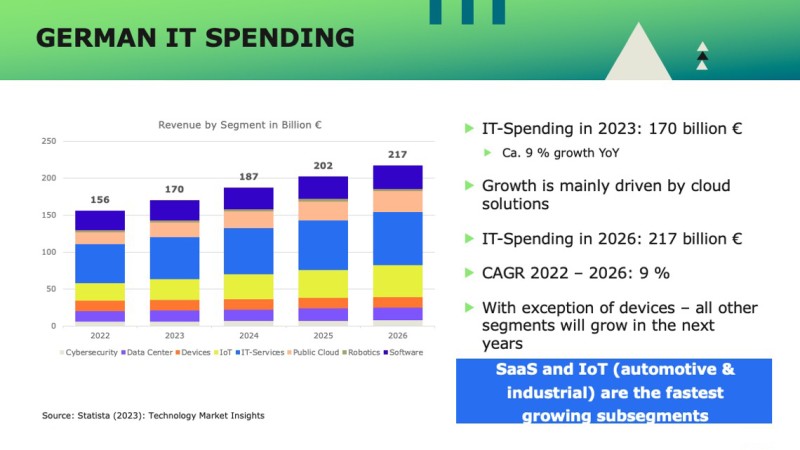

A look at Germany's IT spending

In 2023, €170 billion is expected to be spent on IT in Germany. This corresponds to a growth rate of about 9 per cent compared to the previous year. A compound annual growth rate of 9 percent is also expected for the next three years. This will lead to a market volume of €217 billion in 2026.

Just as in the European market, growth in Germany will also be driven significantly by the cloud business in the coming years. But basically, with the exception of the Devices segment, all market segments will grow in the next few years. SaaS (Software as a Service) and IoT (Internet of Things) are expected to grow the fastest. Growth will focus in particular on the automotive and industrial IoT sectors.

The Key to Success: Key Factors Influencing Channel Performance

Now the question arises what impact the developments described above have on the channel. We see three main factors that will influence the performance of the channel in the future. These are the infrastructure hardware supply , the shift in product mix and the services acceleration .

- Infrastructure hardware supply

25 percent of European companies struggle to control their cloud costs. According to an IDC survey, this is the main reason for the failure of cloud projects. Therefore, customers are re-evaluating their public cloud strategies and turning to experienced, competent partners for support in building and deploying complex hybrid solutions.

We have been seeing for some time that delivery times are shortening again and delivery dates can be better predicted. According to CONTEXT, there are still delivery times of 6 months and more for some products, but the situation is still improving overall. Partners are now able to process their outstanding orders – especially in the areas of networking and data center equipment. This also has a positive effect on the software business.

In addition, the aspect of sustainability is increasingly coming to the fore due to legal regulations and rising energy and raw material costs. The demand for sustainable and energy-efficient solutions is increasing and is another driver for the modernization of IT infrastructure. - The shift in product mix

The sales mix is changing. The devices segment is largely saturated. Growth has shifted away from devices and toward networking, edge infrastructure, cloud, software, and services. Cybersecurity will also remain in the focus of companies. This shift has an impact on numerous products and services. Partners who have a strong focus on client hardware may find it increasingly difficult to survive in the market in the future. A broad product portfolio will be a key strength of sales partners in the future. However, this is not feasible for every partner. Larger partners can inevitably offer a wide range of products. Smaller distributors will be forced to specialize. In this context, if they succeed to shift from less profitable devices to more profitable infrastructure solutions, they will boost their profitability. - Services acceleration

Services are playing an increasingly important role for distributors. With their help, they can create real added value for their customers and thus differentiate themselves from competitors. Services are especially essential when it comes to supporting customers build and deploy hybrid IT solutions.

In addition, services play an elementary role in the identification and management of security threats as well as in the identification of potentials to increase efficiency. The expertise of the partners makes it possible to uncover weaknesses and proactively take measures to minimize risk. At the same time, they support customers in using their resources more effectively and optimising their processes.

The attractiveness of services is underlined by their generally higher profitability. Compared to products, services tend to contribute more to the profit margin. This is not only due to the direct revenue from the services provided, but also to the long-term benefits that come from close cooperation and continuous support.

Against this background, it is clear that the strategic focus on services is recommended, as it offers significant advantages for both customers and providers in the long term.

The Bottom Line

IT investments can provide solutions to many emerging challenges and help create important competitive advantages. That's why, according to IDC, 30 percent of European companies say they will invest in multicloud services, automation, security and data systems in the next 12 months.

One in four European companies admits that they do not have a proper overview of their cloud costs. 17 percent say they didn't have full budget planning when they moved to the cloud. One in two IT leaders is struggling with problems caused by a lack of preparation for the move to the cloud. That's why customers are already in the process of re-evaluating their public cloud strategies. They will turn to experienced and competent partners for support in building and operating complex hybrid solutions. Therefore, our first conclusion is: The risks created by the current macroeconomic situation can be turned into opportunities.

The second conclusion is: The channel is becoming more important. With its large number of potential partners, it can best meet the needs of manufacturers and customers. The large distributors have financial resilience and also the greater support of the manufacturers. However, they may lack agility and flexibility. In this way, smaller sales partners have the opportunity to create real added value through special services and thus stand out from the competition.

There will be a higher demand to optimize the public cloud strategy, the demand for complex hybrid solutions will increase as well as the requirement to offer sustainable solutions. And all of this will increase the relevance of the channel.

Will manufacturers be tempted to expand their direct business under pressure to cut costs? Yes. But many others will take the opposite approach. IBM, Salesforce, AWS and Google Cloud are just a few of the providers that want to expand their channel business in the future.

Partners are becoming increasingly important to support customers throughout the entire product life cycle to drive renewals and thus create long-term value. The flexibility to choose from a variety of different offerings to meet customers' unique business needs is a key benefit of channel partners. Therefore, channel partners are well advised to form strategic alliances in order to jointly cover the entire value chain and the entire life cycle of IT products. What one can't do, many can. And everyone can benefit from it.